Most paid programs have a product key. In most cases it is usually a code that allows you to unlock the program and easily use it. It may be possible to download and install the program on to your computer, but you may be unable to use it until you have the product key. Some programs lock some of the premium features until you pay the product key. Whatever the situation is, you will be unable to fully use the program until you have the product key, which is usually paid for.

Microsoft Office 2016 apps also have a product key. The suite that bundles all the office programs together can be accessible online or in offline computer stores. But once you install it on your computer, the program will ask for a product key. Usually, Microsoft Office will work for a specified trial period before the product key is required. In this article, we take a closer look at the all-important Microsoft office 2016 product key and how to use it.

1. Features of Microsoft Office 2016

2. What is Microsoft office 2016 Product Key

3. List of Microsoft Office Product Key

4. How to Download Original MS Office 2016 ISO

5. Activating Microsoft Office 2016 Using a Product Key

6. Activate MS Office 2016 without a Product Key

7. Tip: Forgot Official File Password? How to Recover the Password

1. Features of Microsoft Office 2016

The latest version of Microsoft Office 2016 was released in January 2018, including the latest version of all the programs under that suite. These include Word. Excel, Outlook, PowerPoint and Access. Along with the new features, Microsoft has also included a much more improved version of the Data loss Protection (DPL) in the software. Updates of the Microsoft Office 2016 suite will also be available to users for free every month.

Microsoft has also gone a step further and given the individual programs in the suite a face lift. Most users are praising the much improved interface that has made it easier to create documents. The programs are also running much more smoothly. The following are just some of the features you can expect to enjoy when you activate the new Microsoft office 2016 product key:

-

Document creation, editing and opening will be much easier.

-

Search tools are much more functional.

-

You will be able to access online and offline versions of MS Office.

-

The interface is much more enhanced.

-

A retina display makes the use of these programs much more pleasant.

The different retail suites of Microsoft Office 2016 include:

-

Home & Student

-

Home & Business

-

Standard

-

Professional

-

Professional Plus

2. What is Microsoft office 2016 Product Key

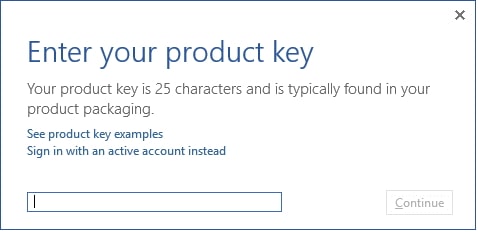

When you purchase your Microsoft Office 2016 suite and install it on your computer for the first time, you will be required to enter a 25-character code. This code is what is known as the Microsoft Office Product Key and it's usually in the following format:

XXXXX-XXXXX-XXXXX-XXXXX-XXXXX

How you acquired your Microsoft Office 2016 suite will determine how you get the product key. The suite can be preinstalled on your computer or you can download it from an online store or even purchase it from a physical store. Either way, you will need the product key before you can activate the program.

3. List of Microsoft Office Product Key

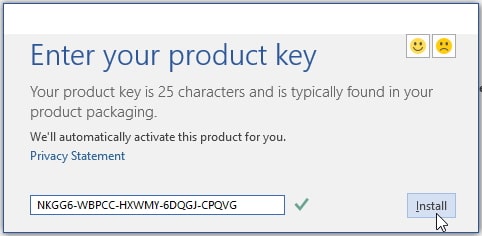

The following are some Microsoft Office 2016 Product keys that will work for programs downloaded or purchased in 2019.

W2J6F-VNXJD-FFHBG-MQKPM-39M3P

NKGG6-WBPCC-HXWMY-6DQGJ-CPQVG

9C2PK-NWTVB-JMPW8-BFT28-7FTBF

PD3PC-RHNGV-FXJ29-8JK7D-RJRJK

GNH9Y-D2J4T-FJHGG-QRVH7-QPFDW

R69KK-NTPKF-7M3Q4-QYBHW-6MT9B

C2FG9-N6J68-H8BTJ-BW3QX-RM3B3

J484Y-4NKBF-W2HMG-DBMJC-PGWR7

YG9NW-3K39V-2T3HJ-93F3Q-G83KT

DR92N-9HTF2-97XKM-XW2WJ-XW3J6

J7MQP-HNJ4Y-WJ7YM-PFYGF-BY6C6

869NQ-FJ69K-466HW-QYCP2-DDBV6

JNRGM-WHDWX-FJJG3-K47QV-DRTFM

7WHWN-4T7MP-G96JF-G33KR-W8GF4

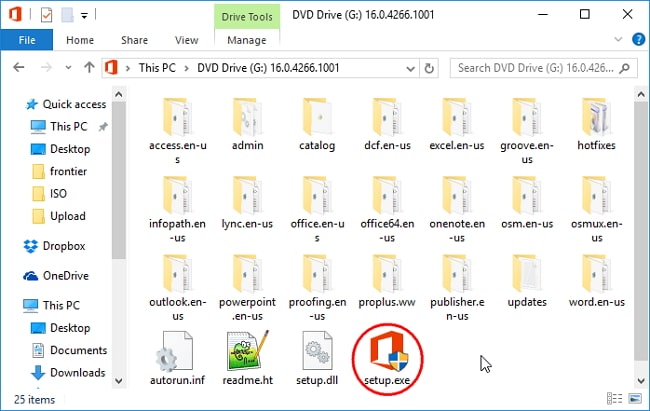

4. How to Download Original MS Office 2016 ISO

You can get the latest version of Microsoft Office from the official Microsoft website here https://www.microsoft.com/. Once the download is complete, you need to extract the ISO image from the zip files named:

"SW_DVD5_Office_Professional_Plus_2016_W32_English…" for the 32-bit

"SW_DVD5_Office_Professional_Plus_2016_W64_English…" for the 64-bit

Keep in mind that the ISO file is used to burn CD or DVD, but you can also install Office 2016 without having to burn it using 7-Zip or another archive program. Once you have extracted the ISO file, you should get a list of files, one of them is a setup.exe file. Follow these simple steps to install the suite.

Step 1: To install MS Office 2016, run the setup.exe file. Accept terms and conditions and then click "Continue".

Step 2: Click on "Install Now" and by default, Windows will install MS Office Suite in the default C:\Prorgam Files.

5. Activating Microsoft Office 2016 Using a Product Key

Follow these simple steps to activate your Microsoft Office 2016 using a product key.

Step 1: Download Microsoft Office 2016 and then run the setup to install the program on your computer like we outlined in the previous section.

Step 2: Once the program is installed, disconnect the computer from the internet and then enter one of the product keys on this article.

6. Activate MS Office 2016 Without a Product Key

If you are unable to use a product key to activate MS Office 2016 with a product key, you may want to consider activating the suite without a product key. Keep in mind that only Microsoft Office Standard 2016 and Microsoft Office Professional Plus 2016 can be activated without a product key. Here's how to do it.

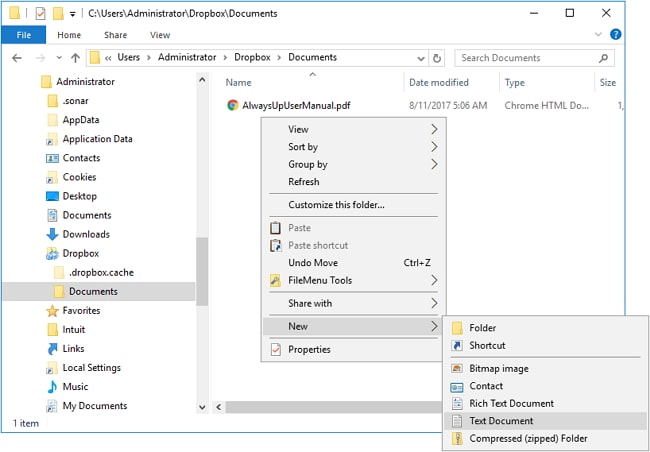

Step 1: Create a new text document and then copy the following code and paste it into the text document.

@echo off

title Activate Microsoft Office 2016 ALL versions for FREE!&cls&echo ============================================================================&echo #Project: Activating Microsoft software products for FREE without software&echo ============================================================================&echo.&echo #Supported products:&echo - Microsoft Office Standard 2016&echo - Microsoft Office Professional Plus 2016&echo.&echo.&(if exist "%ProgramFiles%\Microsoft Office\Office16\ospp.vbs" cd /d "%ProgramFiles%\Microsoft Office\Office16")&(if exist "%ProgramFiles(x86)%\Microsoft Office\Office16\ospp.vbs" cd /d "%ProgramFiles(x86)%\Microsoft Office\Office16")&(for /f %%x in ('dir /b ..\root\Licenses16\proplusvl_kms*.xrm-ms') do cscript ospp.vbs /inslic:"..\root\Licenses16\%%x" >nul)&(for /f %%x in ('dir /b ..\root\Licenses16\proplusvl_mak*.xrm-ms') do cscript ospp.vbs /inslic:"..\root\Licenses16\%%x" >nul)&echo.&echo ============================================================================&echo Activating your Office...&cscript //nologo ospp.vbs /unpkey:WFG99 >nul&cscript //nologo ospp.vbs /unpkey:DRTFM >nul&cscript //nologo ospp.vbs /unpkey:BTDRB >nul&cscript //nologo ospp.vbs /unpkey:CPQVG >nul&cscript //nologo ospp.vbs /inpkey:XQNVK-8JYDB-WJ9W3-YJ8YR-WFG99 >nul&set i=1

:server

if %i%==1 set KMS_Sev=kms7.MSGuides.com

if %i%==2 set KMS_Sev=kms8.MSGuides.com

if %i%==3 set KMS_Sev=kms9.MSGuides.com

if %i%==4 goto notsupported

cscript //nologo ospp.vbs /sethst:%KMS_Sev% >nul&echo ============================================================================&echo.&echo.

cscript //nologo ospp.vbs /act | find /i "successful" && (echo.&echo ============================================================================&echo.&echo #My official blog: MSGuides.com&echo.&echo #How it works: bit.ly/kms-server&echo.&echo #Please feel free to contact me at msguides.com@gmail.com if you have any questions or concerns.&echo.&echo #Please consider supporting this project: donate.msguides.com&echo #Your support is helping me keep my servers running everyday!&echo.&echo ============================================================================&choice /n /c YN /m "Would you like to visit my blog [Y,N]?" & if errorlevel 2 exit) || (echo The connection to my KMS server failed! Trying to connect to another one... & echo Please wait... & echo. & echo. & set /a i+=1 & goto server)

explorer "http://MSGuides.com"&goto halt

:notsupported

echo.&echo ============================================================================&echo Sorry! Your version is not supported.&echo Please try installing the latest version here: bit.ly/downloadmsp

:halt

pause

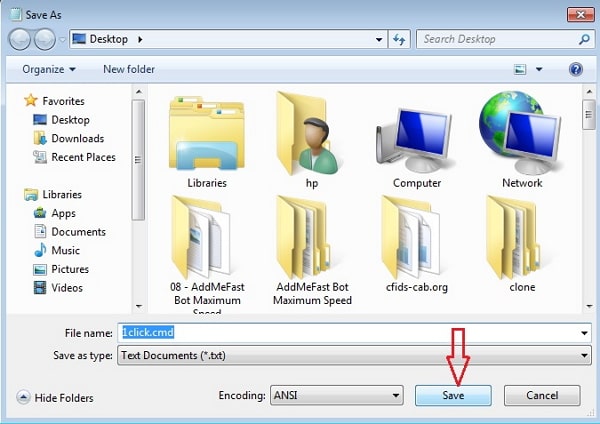

Step 2: Save the text file as a batch file and name it "1click.cmd".

Step 3: Run the batch file as "Administrator" and Microsoft Office 2016 will be successfully activated.

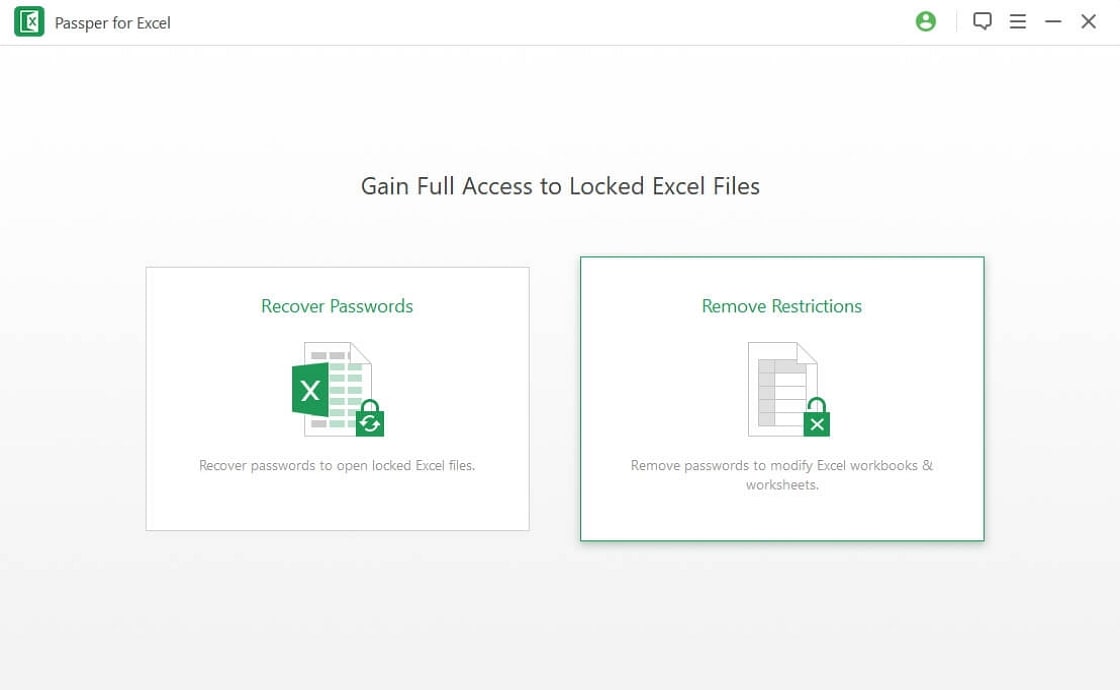

7. Tip: Forgot Official File Password? How to Recover the Password

One of the features you can expect to continue to enjoy with this version of Excel is password-protection. Yet, we all know how hard it can be to try and recover a lost password. One of the best ways to do it is to use Passper for Excel, a password recovery tool that is designed to work with Microsoft Office suite to help you recover any password without affecting any of the data on the device. The program has a very high success rate and features that allow you to recover the password. These features include the following:

-

It recovers opening password protection and removes worksheet or workbook protection without affecting the data on the document.

-

It can be used to recover a password regardless of the situation you are in; whether you've forgotten the password or you can't edit the content or copy the content on the workbook.

-

It is also very easy to use, allowing you to recover the password in 3 simple steps and remove restrictions in a single click.

-

It utilizes 4 attack modes that make it one of the most effective password recovery tools in terms of success rates.

-

The program can also save the recovery status at any time if you need to stop the recovery process.